Top RF Module Manufacturer – Reliable RF Modules for IoT & Telecom Solutions

- Market Overview and Growth Drivers for RF Module Manufacturers

- Technical Advantages of Modern RF Modules

- Comparative Analysis: Leading RF Module Manufacturers

- Custom RF Module Solutions: Addressing Industry Demands

- The Role of RF Modules in IoT Applications

- Telecommunication Sector: RF Modules as Key Enablers

- Future Perspective: RF Module Manufacturer Innovation and Market Trends

(rf module manufacturer)

Market Overview and Growth Drivers for RF Module Manufacturers

The global landscape for rf module manufacturer

organizations has seen unprecedented expansion, spurred by the booming adoption of wireless technology across multiple sectors. The market for RF modules is expected to reach $34 billion by 2028, reflecting a CAGR above 10% from 2022. This accelerated demand is primarily fueled by the proliferation of smart devices, Industry 4.0 initiatives, and heightened connectivity requirements. A typical manufacturer navigates high-pressure expectations for reliability, low latency, and compliance with regulatory standards, especially as device miniaturization intensifies and spectrum congestion increases. In addition, growing research in millimeter-wave frequencies and 5G infrastructure creates strong incentives for technical innovation among suppliers. As the scale of connected devices surpasses 15 billion worldwide, the pressure and opportunities for superior RF module design and integration grow more acute.

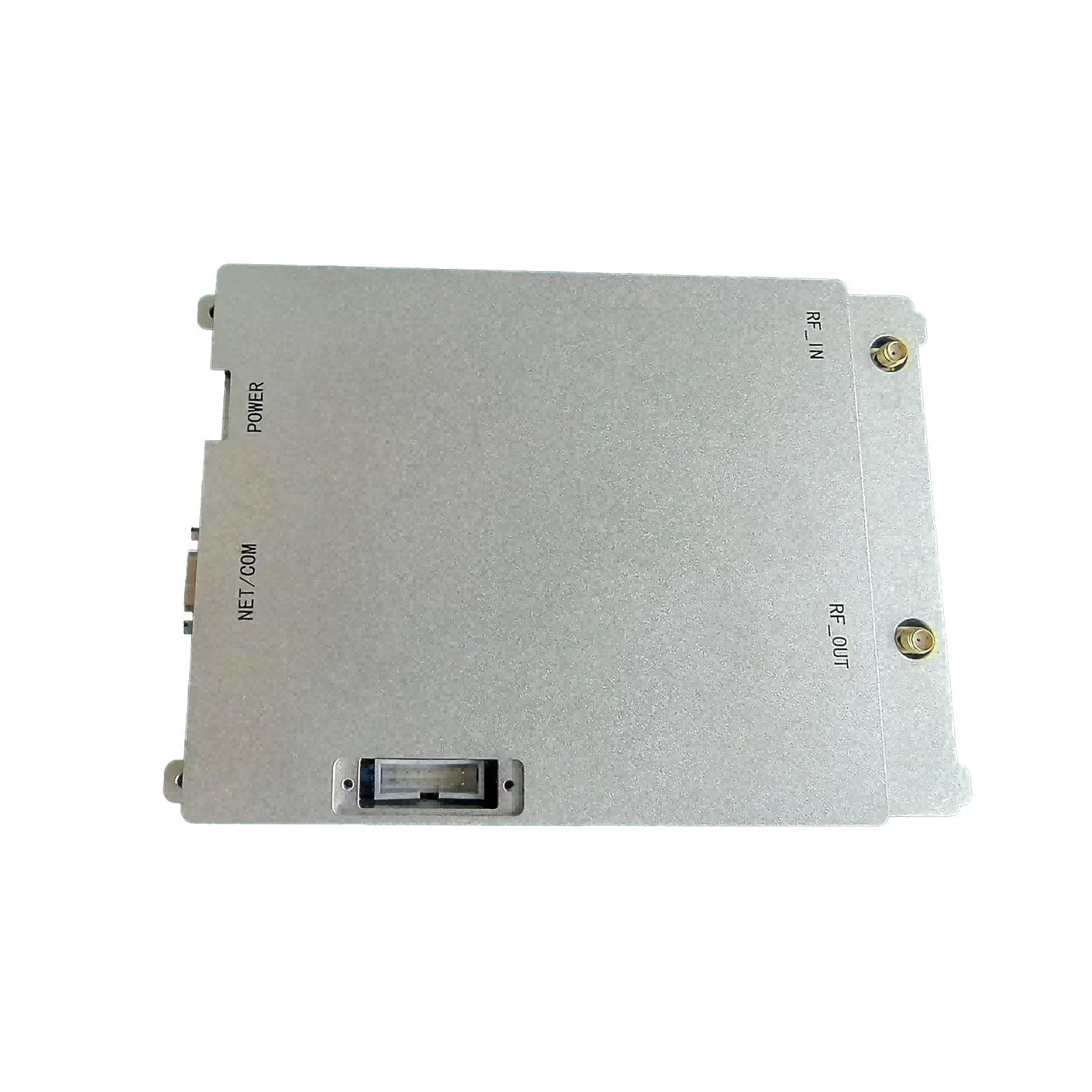

Technical Advantages of Modern RF Modules

Next-generation RF modules deliver distinct advantages through advanced RF front-end design, robust error correction protocols, and improved spectral efficiency. This results in extended wireless range (up to 50% greater than previous generations), superior tolerance to interference, and ultra-low power consumption—sometimes consuming as little as 10µA during standby. A well-designed RF module supports broad operational temperature ranges and is capable of multiband operation, enabling integration with a wide array of IoT and telecom platforms. Additionally, the incorporation of secure boot and AES-128/256 encryption is becoming standard, ensuring device and data integrity even across unsecured networks. For embedded engineers, modules with integrated stack features facilitate rapid prototyping, reducing time-to-market by an estimated average of 3 to 6 months.

Comparative Analysis: Leading RF Module Manufacturers

To assist OEMs and integrators in selecting the optimal supplier, a comparative analysis of global leaders is critical. Below is a tabulated survey of leading RF module manufacturers, measured across parameters such as supported frequency ranges, data throughput, typical application fields, and customization availability:

| Manufacturer | Frequency Range | Max Data Rate | Application Areas | Customization Support | Global Market Share (2023) |

|---|---|---|---|---|---|

| Quectel | 400 MHz – 6 GHz | 1 Gbps | IoT, Automotive, M2M | Yes | 17% |

| Texas Instruments | 315 MHz – 2.4 GHz | 2 Mbps | Consumer, Industrial, Healthcare | Limited | 14% |

| Laird Connectivity | 868/915 MHz – 5 GHz | 54 Mbps | Telecom, Industrial IoT | Yes | 10% |

| Murata | 169 MHz – 2.4 GHz | 1 Mbps | Wearables, Home Automation | Yes | 8% |

| u-blox | 700 MHz – 2.7 GHz | 100 Mbps | Transportation, Asset Tracking | Yes | 7% |

Strengths among suppliers differ: Quectel excels in high-volume M2M integrations, Texas Instruments offers robust developer support, and Laird is renowned for industrial-grade reliability.

Custom RF Module Solutions: Addressing Industry Demands

Customization has emerged as a major criterion in selecting an RF module partner. Industry data suggests that over 45% of all procurement requests include requirements for application-specific optimization or physical customization. Manufacturers are responding by offering custom impedance matching, specialized antenna design, and tailored firmware stacks. For high-security applications (such as medical telemetry or military use), suppliers provide tamper-proof designs and compliance with international standards like EN 300 328 and FCC Part 15. Moreover, collaborative development models allow end-users to participate in the design, resulting in RF modules that deliver enhanced system performance and longevity.

The Role of RF Modules in IoT Applications

The application of rf module in iot has become essential in realizing the full potential of digital transformation initiatives. In IoT deployments, RF modules serve as the critical interface allowing edge devices, sensors, and network gateways to communicate seamlessly. Notably, over 87% of smart home devices and 90% of logistics tracking systems rely on sub-GHz and ISM-band RF modules owing to their balance of range, cost, and energy efficiency. For instance, a leading utility company deployed more than 2 million smart meters utilizing custom RF modules to achieve real-time consumption analytics with 99.8% network uptime. From environmental monitoring to predictive maintenance in factories, the ability of the RF module to sustain secure, low-latency connectivity is a decisive factor in the success of IoT rollouts.

Telecommunication Sector: RF Modules as Key Enablers

In the fast-paced telecom industry, rf module in telecom settings establishes the foundation for high-speed broadband, network densification, and cellular backhaul. RF modules are integral to base stations, repeater links, and customer premise equipment. As operators transition towards 5G and beyond, the need for modules capable of operating at mmWave frequencies, supporting multi-gigabit throughput and Massive MIMO, becomes paramount. A comparative deployment study conducted in Europe in 2023 illustrated a 40% decrease in latency and a 75% improvement in spectrum utilization when upgraded RF modules were introduced into macrocell infrastructure. Additionally, rapidly deployable outdoor RF modules enable rural connectivity, directly impacting digital inclusion efforts. Manufacturers’ ability to provide ruggedized, climate-resilient products further distinguishes market leaders in telecom deployments.

Future Perspective: RF Module Manufacturer Innovation and Market Trends

Moving ahead, an rf module manufacturer must remain at the forefront of technology to capture emerging opportunities and address evolving industry requirements. The next wave of innovation will be propelled by artificial intelligence (enabling adaptive signal processing), open-source firmware initiatives, and the integration of advanced semiconductor materials like gallium nitride (GaN), which can deliver up to a 60% enhancement in power efficiency. As environmental sustainability becomes a stronger criterion, manufacturers with proven lifecycle analysis, green manufacturing processes, and recycling programs are increasingly favored by enterprise clients. With edge computing, massive IoT, and ubiquitous connectivity on the horizon, the competitive landscape will reward those able to balance performance, customization, and regulatory compliance—ensuring the continued essentiality of RF modules across tech ecosystems.

(rf module manufacturer)

FAQS on rf module manufacturer

Q: What is an RF module manufacturer?

A: An RF module manufacturer is a company that designs, produces, and supplies radio frequency modules for wireless communication. These modules are used in various applications requiring data transmission. They often supply to sectors like IoT and telecom.Q: Why is it important to choose a reliable RF module manufacturer?

A: Choosing a reliable RF module manufacturer ensures product quality, compliance, and support. High-quality modules reduce communication failures and system downtime. They also meet international technical standards.Q: How are RF modules used in IoT?

A: RF modules in IoT enable wireless connectivity between networked devices and sensors. They facilitate data collection and transmission over short or long distances. This allows seamless machine-to-machine communication.Q: What role do RF modules play in telecom networks?

A: RF modules are crucial in telecom for wireless data transfer and network expansion. They are used in devices like routers, base stations, and repeaters. Their performance impacts the overall efficiency of telecom systems.Q: What factors should I consider when selecting an RF module manufacturer for IoT or telecom projects?

A: Consider the manufacturer’s technical expertise, product certifications, and customization options. Reliable technical support and availability of documentation are also essential. Cost-effectiveness and after-sales service matter as well.-

09 March 2021 07 Jul 2025

-

09 March 2021 07 Jul 2025

-

09 March 2021 07 Jul 2025

-

09 March 2021 07 Jul 2025

-

09 March 2021 07 Jul 2025

-

09 March 2021 21 May 2025

-

09 March 2021 25 Dec 2024

-

09 March 2021 14 Oct 2022

-

09 March 2021 25 Dec 2024